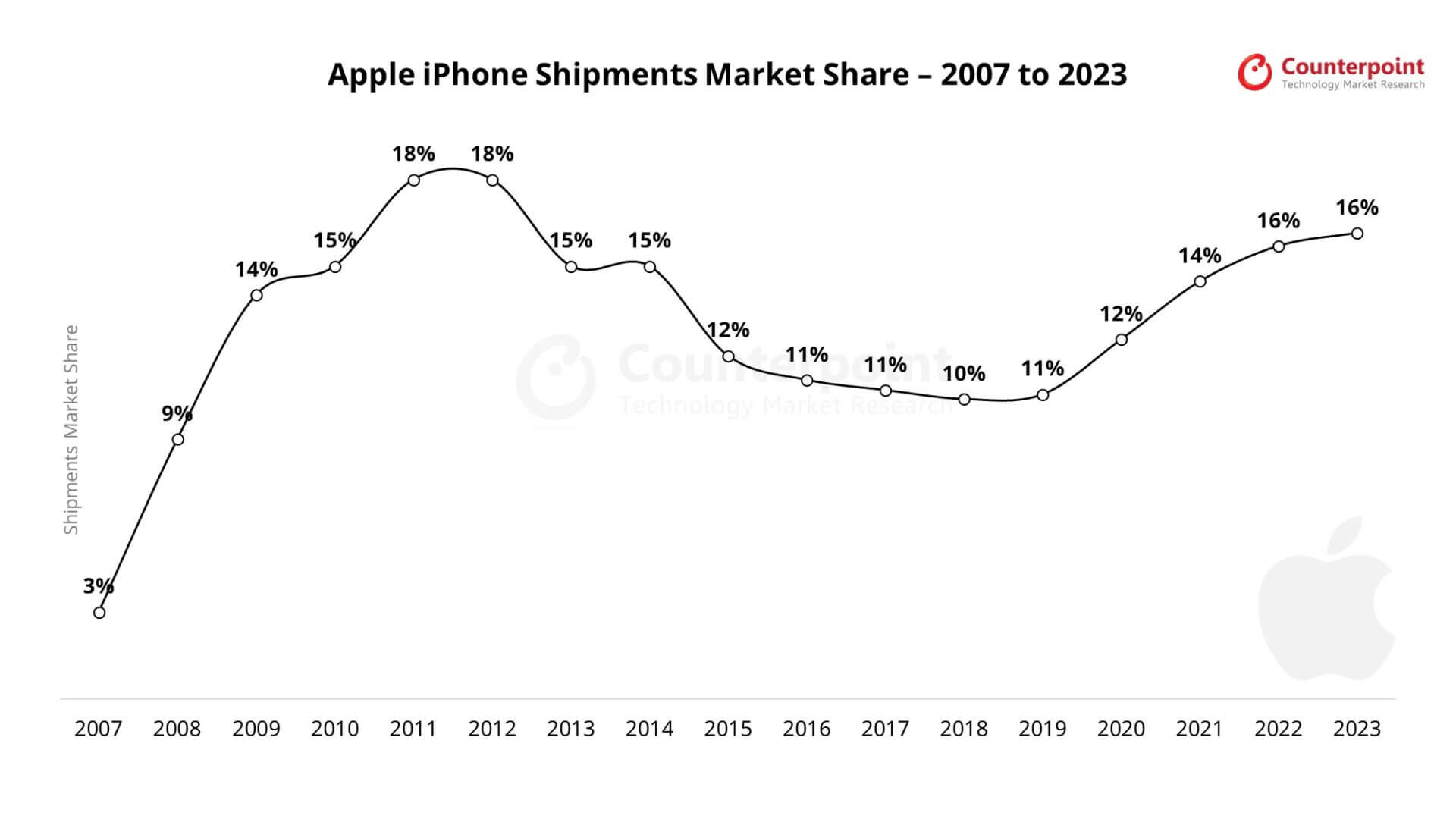

In 2020, the European smartphone market experienced rollercoaster-like ups and downs. At the beginning of the year, the COVID-19 epidemic hit the area severely, and both supply and demand problems appeared. At the same time, consumers have cut their spending due to economic and employment issues, and the lockdown has also made it impossible or unwilling to go out to buy new mobile phones.

Jan Stryjak, deputy director of Counterpoint Research, commented on the entire market, "In April, the market fell to the bottom, and sales plummeted nearly 50% year-on-year. Since then, the number of confirmed cases in warming weather has decreased, countries have begun to relax control, and the smartphone market has gradually recovered in the summer. However, the second round of the epidemic hit in September, and the number of confirmed cases surges. Countries began to implement a new round of lockdowns in November, so the market fell again at the end of the year. Although Apple released the new iPhone 12 series in October, it could still reverse the downward trend. Overall, the European smartphone market in 2020 will fall by 14% year-on-year. "

Figure 1: The impact of the Covid-19 epidemic on smartphone sales in Europe

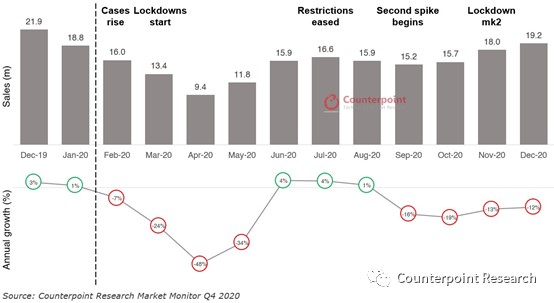

Stryjak added, "Also to the cause of the epidemic, the US ban has prevented Huawei from launching new models and mass-produce existing models. This creates opportunities for other manufacturers, so despite the extremely difficult 2020, there are still manufacturers that achieve growth. "

Figure 2: Sales share and growth of major European manufacturers in 2020

Manufacturers who achieved growth:

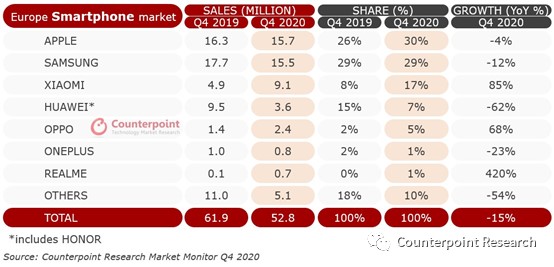

- • Xiaomi achieved great success in Europe in 2020, ranking third in the market. Xiaomi performed well in Spain and Italy, with sales shares reaching 28% and 17% in the fourth quarter. In 2020, Xiaomi achieved significant year-on-year growth of 90% in Europe.

• In 2020, Apple''s sales experienced a slight drop. The main reason was that Apple delayed the release of the iPhone 12 series. But, after the iPhone 12 series was launched in October, the market responded enthusiastically, and Apple''s market share reached 30% in the fourth quarter, setting a record high.

• OPPO entered the European market in 2018 but did not make significant progress until 2020. OPPO has established cooperation with Europe''s largest operators Vodafone, Telefónica, Orange, and Deutsche Telekom, and has established inventory in major operator channels.

• Realme is the fastest-growing brand in Europe, with sales increasing more than ten times compared to 2019. Realme''s strong value proposition has enabled it to achieve rapid growth in price-sensitive Italy, Spain, and Eastern Europe.

Manufacturers who in a difficult situation:

• Huawei was unable to produce competitive smartphones due to the US ban and almost withdrew from the European market. In 2020, Huawei''s market share fell from 15% in January to 5% in December, and this trend is expected to continue in 2021.

• Samsung has had a challenging year. First, the flagship model Galaxy S20 is not selling well. Second, the European market is extremely competitive. Third, Apple''s release of the new iPhone 12 5G means that Samsung has ended its monopoly on the high-end 5G market. Although the new Galaxy S21 is expected to lead the Android camp in 2021, Samsung must work very hard to achieve this goal.

Figure 3: Sales share and growth of major European manufacturers in the fourth quarter of 2020

Sales growth during the Christmas period in Europe means that the market outlook for 2021 is optimistic. Research analyst Ankit Malhotra commented, "In the fourth quarter of 2020, driven by the hot sales of 5G iPhones, the smartphone market performed strongly. It is expected that the iPhone 12 series will continue to be popular in the first quarter of 2021. Coupled with the release of the Galaxy S21 by Samsung, this growth momentum is expected to continue. Samsung and Apple competed to release new flagship phones in the first quarter, coupled with the government''s relaxation of epidemic control and economic recovery, it is expected that the market will pick up quickly in 2021. Besides, we will pay close attention to the development of 5G and the performance of manufacturers such as Xiaomi, OPPO, OnePlus, vivo, and Realme."